Unfortunately, in Japan, credit reporting agencies operate under poor business practices. The company law disclosure requirements make it difficult for private investigation agencies to receive accurate, high-quality information.

In this post, we will discuss:

What Are THe Credit Reporting Agencies?

There are two types of credit reporting agencies; those that report on either individuals or businesses. Usually, the information is acquired through credit card companies, credit unions, and banks. The purpose of collecting this information is for businesses to establish a good line of credit to increase their chances of receiving a loan.

How Do Credit Reporting Agencies Collect Information?

How do those collection methods work in Japan?

There are 12 common ways a business credit reporting agency collects information from businesses :

1.) Payment and banking data from suppliers and creditors.

– Little or no information will be disclosed from banks or creditors in Japan

2.) Suits, liens, and judgments.

– Litigation records are confidential in Japan. Only open media source information is available.

3.) Uniform Commercial Codes (UCC Filings)

– This does not exist in Japan. There is a Companies Act in Japan. But it does require companies to file any derogatory filings or disclose financial data (In fact it does but it is not enforced).

4.) Business Registration (state, city, county courts)

– This is available in Japan.

5.) Incorporation and bankruptcy filings from state and county courts.

– This information is available through the National Gazette

6.) Corporate Financial reports

– With the exception of construction companies, real-estate businesses, and publicly listed companies, other corporations are not obligated to disclose this information. The only information one can receive from other businesses is through direct interviews with the company.

7.) Contracts, grants, loans and debarments from the Federal government.

– It is extremely difficult to obtain this information other than through direct interviews with the company.

8.) Internet web mining. (*The extraction of information from web sources).

– This is possible in Japan.

9.) News stories, media stories and company press releases.

– This information is available in Japan.

10.) The Yellow Pages and other print directories.

– This information is available in Japan.

11.) Direct investigations and interviews with company principals (self-reported data)

– Credit reporting agencies must rely heavily on this information, although it may not always be accurate.

12.) Other companies that have granted a company credit.

– This is possibly available but only on a voluntary basis from related companies.

What Are The Dominant Credit Reporting Agencies In Japan?

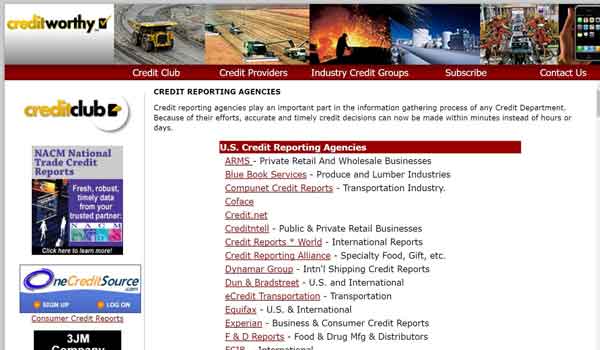

The website Credit Worthy compiled an international list [NW1] of credit reporting agencies that states Teikoku Databank and Tokyo Shoko Research Ltd. are the dominant agencies in Japan. This number may seem quite small as Japan has the third largest economy in the world. However, their business practices speak volumes as to why they remain the Top 2.

How Do Credit Reporting Agents Communicate With Japanese Businesses?

Companies can refuse to answer queries from agents but it may result in a loss of clients. Because of this, it is possible that the information reported may not be an accurate representation of their credit experience.

In addition, when employees of a credit reporting agency conduct a direct interview with a company, they may try to increase their business by selling discounted information for future credit reports on other companies. This creates a multi-layered network among Japanese businesses that is difficult to penetrate.

Unfortunately, Japanese registry records do not list shareholders’ information and source interviews are not considered just business practice in Japanese society. Therefore, private investigation agencies have no choice but to trust the information relayed by credit reporting agencies or the unverifiable information from the company itself.

Conclusion

As a reputable private investigation firm, we do our utmost to ensure the accuracy and quality of the information we relay. Making our clients privy to certain Japanese business practices is one of the ways we maintain our quality of service and set ourselves apart from other private investigation firms.